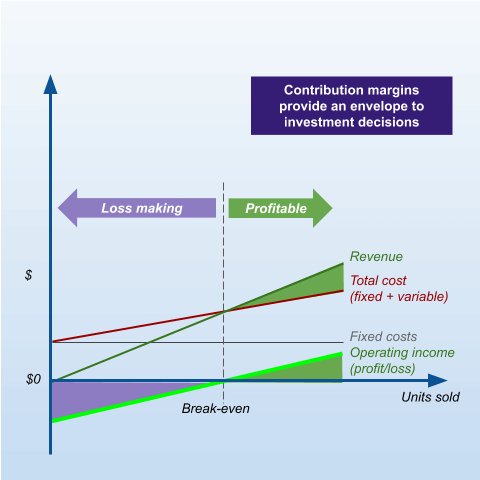

We can further calculate the FIFO Cost of goods sold from the FIFO Inventory to find the gross profit and profitability ratios. Besides, financial ratios are very crucial when comparing the performance of different companies working in the same industry. When the external stakeholders are analyzing the company’s financial health and position in the market, they mainly rely on the financial ratio analysis. Financial ratio analysis offers great insight into the performance of the company. The most commonly compared and used methods are LIFO and FIFO methods. The most recent inventory stock is used in the LIFO method first, and the older stock is used later.

If LIFO reserve declines in a rising price environment, then the analyst might become suspicious that current profit margins are over-stated because older goods are being sold and not replaced. Replacing these goods at current cost might be higher than COGS is indicating.

Sign Up For The Dummies Beta Program To Try Dummies’ Newest Way To Learn

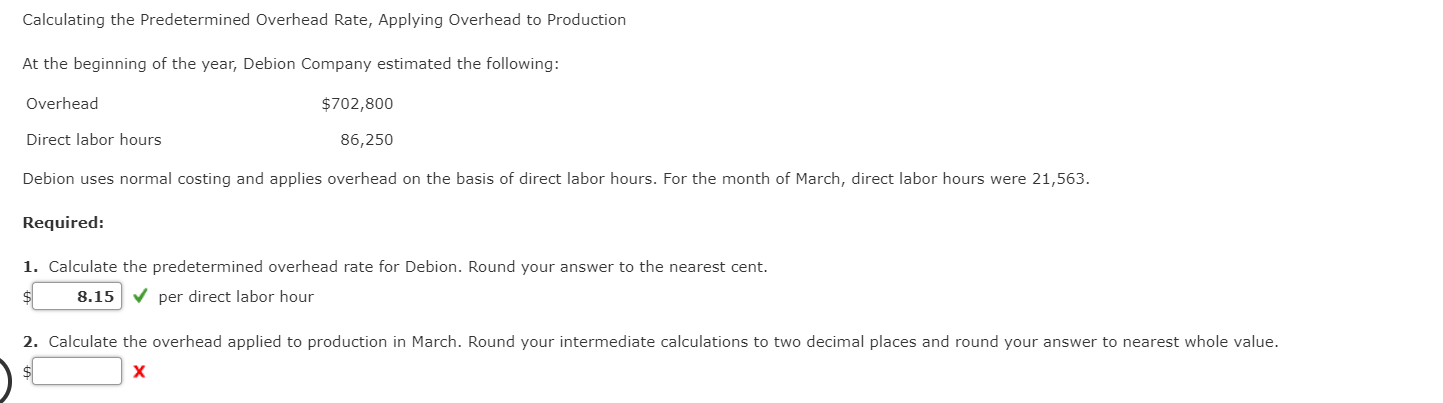

The Last-In, First-Out method assumes that the last unit to arrive in inventory or more recent is sold first. The First-In, First-Out method assumes that the oldest unit of inventory is the sold first. LIFO reserve is the difference between what the company’s ending inventory would have been under FIFO accounting and its corresponding value under LIFO accounting. Get answers to who should use the LIFO method, how much LIFO may benefit your company or client & good LIFO candidates by industry & principal business activity along with historical inflation data. It is difficult to calculate the value as per the LIFO method as lots of effort and concentration are required. There are also chances of errors due to manual intervention as the value as per LIFO cannot be calculated by the system properly. 470 units are first sold from purchases of 500 units; hence, the closing stock is 30 units from new purchases and 40 units from opening stock.

- The objective of using LIFO for external purposes is the inflationary economic conditions resulting in higher inventory costs.

- The LIFO method offers two major advantages related to satisfying the matching principle and paying taxes.

- The process involves gauging inventory values under both methods.

- This leads to a higher cost of goods sold under LIFO, which results in lower reported earnings.

- The conformity rule of IRC § 472 requires those companies to also use it for financial accounting purposes.

In order to create a balance between the two methods and to give a fuller picture of a company’s financial realities, the LIFO reserve account is necessary. The LIFO reserve is designed to show how the LIFO and FIFO inventory valuation systems work and the financial differences between the two. By using the LIFO reserve of company A, we can find the FIFO inventory and compare the current ratios of both companies. But there are certain ratios like inventory turnover ratios, inventory cycles, etc., that can only be compared LIFO Reserve and LIFO Effect if the same inventory method is used. The inventory goes out of the stock in the same pattern in the FIFO method as it comes in. In a persistently deflationary environment, it is possible for the LIFO reserve to have a negative balance, which is caused by the LIFO inventory valuation being higher than its FIFO valuation. To compute the FIFO amount of cost of goods sold of company A, the change in the LIFO reserve account during the period would be subtracted from the LIFO amount of the cost of goods sold of company A.

Explain The Following Terms A Lifo Layerb Lifo Reservec Lifo Effect

The LIFO method of evaluating inventory is when the goods or services produced last are the ones to be sold or disposed of first. FIFO shows attractive returns to investors whereas LIFO reduces taxes due to the specific calculations of each method. LIFO is where the last produced assets are sold first while FIFO is where the first assets produced are sold first. Last in, first out and first in, first out are the two methods of evaluating inventory. Calculate current ratio for both companies with and without LIFO adjustment for company X.

With consistently increasing costs the balance in the LIFO reserve account will be an ever-increasing credit balance that reduces the company’s FIFO inventory cost. The change in the balance during the current year represents the current year’s impact on the cost of goods sold. Used to adjust the difference in inventory valuation due to other methods of valuation. Income taxes are added on the change in LIFO Reserve to income tax expense in the profit & loss statement. The contra inventory account will reduce the recorded cost of inventory.

How To Calculate Inventory Turnover Ratio Using Sales & Inventory

If we subtract the LIFO Effect from the Cost of Goods sold in LIFO inventory, it will give COGS under the FIFO Inventory method. The LIFO reserve is to be added to the shareholder’s equity. The reserve should be adjusted to reflect tax changes. For instance, the current ratio is the most used and popular ratio to assess a company’s liquidity.

- As the LIFO reserves have accumulated tax deductions which have been enjoyed by the dealership and its owners, the result has generally enhanced dealership working capital.

- It is also called the allowance to reduce inventory to LIFO.

- To compute the FIFO amount of cost of goods sold of company A, the change in the LIFO reserve account during the period would be subtracted from the LIFO amount of the cost of goods sold of company A.

- If the LIFO layers of inventory are temporarily depleted and not replaced by the fiscal year-end, LIFO liquidation will occur resulting in unsustainable higher gross profits.

- LIFO use, once widespread, declined over several decades as inflation and corporate income tax rates fell, reducing LIFO’s tax benefits.

- LIFO can seriously distort financial statements and is frequently used to manage earnings.

This allows companies to better adjust their financial statements and budget in regards to sales, costs, taxes, and profits. When costs are decreasing over time, your recent inventory purchases are cheaper than your older purchases. Under LIFO, your cost of goods sold would be lower and your reported earnings would be higher.

How Lifo Affects Cash Flow?

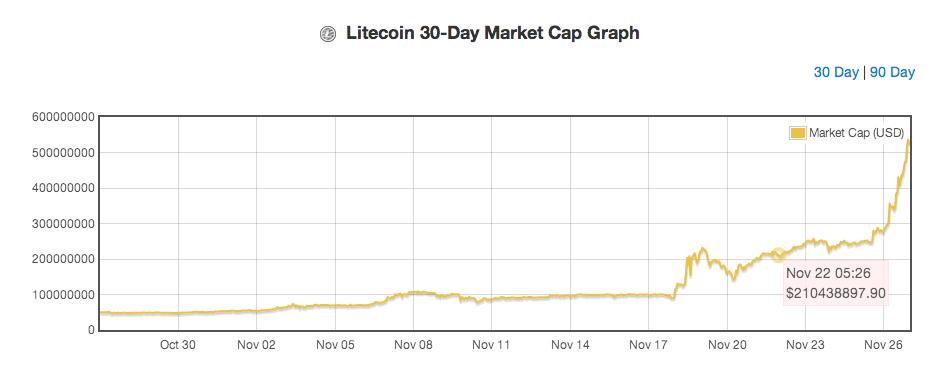

Or they could wait and see what happens, anticipating some exception to the conformity principle or an extended section 481 period. Large oil companies electing LIFO reported an average 280 percent increase in LIFO reserves between https://accountingcoaching.online/ 2020 and 2021, while non-oil companies electing LIFO reported an average increase of about 20 percent. Assuming oil companies accounted for half of LIFO reserves in 2020, taxing current LIFO reserves could raise about $100 billion.

- Effect of Inflation If costs are increasing, the items acquired first were cheaper.

- Last-in, first-out is one of several methods a business may use to account for the cost of its inventory for financial reporting purposes.

- An entity makes retrospective application only for the direct effects of the change .

- Many companies use LIFO primarily because it allows lower income reporting for tax purposes.

- LIFO reserve represents the difference between the inventory value under the FIFO and LIFO valuation methods.

So far, discussions have been based on the assumptions of rising prices and stable or growing inventory quantity. However, LIFO reserves can decline for either of the two reasons listed below.

Fifo Vs Lifo

LIFO reserve allows companies to estimate the gap between the FIFO and LIFO inventory valuation methods. It is critical when companies use different approaches to evaluating inventory internally and externally. In accounting, LIFO reserve refers to the contra account that includes the balance for that difference. It can help explain the variance between the cost of goods sold and inventory value under both approaches. Companies can use multiple inventory valuation methods to estimate the value of their goods. However, accounting standards only allow specific valuation methods when reporting inventory in the financial statements.

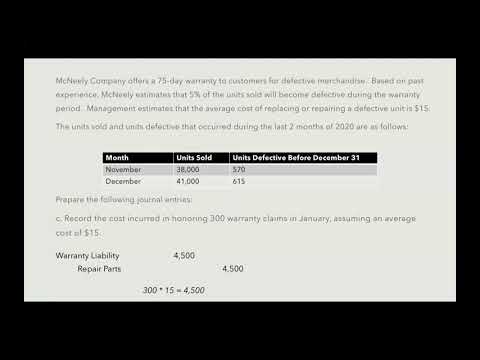

But as long as they are the same, standardized widgets, Batch 3 goods are unsold for the purposes of accounting. Calculating LIFO reserve requires adjusting two areas. These include the cost of goods sold and the value of inventory. When calculating LIFO reserve, companies can use the following formula. The impact of the LIFO reserve can vary depending on how the transaction is handled. If the dealership buy-sell is an asset sale, the selling dealership entity would likely recapture the entire LIFO reserve as ordinary income in the year of sale. In this instance the actual tax liability on the LIFO reserve has been triggered in full.

For such businesses, it’s easy to perform a physical inventory count. It’s also far simpler to estimate the cost of goods sold over designated periods of time. The credit balance in the LIFO reserve reports the difference since the time that LIFO was adopted. The change in the balance during the current year represents the current year’s impact on the cost of goods sold. The Inventory Price Index Computation method allows taxpayers to use published external indexes to calculate inflation for the purpose of valuing LIFO inventories.

It is the method used to measure the cost of inventory or account for inventory. In this method, the last purchased goods or recent products are sold or used first. This amount is always positive in an inflationary environment and always negative in a deflationary environment, which covers case above. Note that the change in inventory units (units purchased – units sold) will not affect the sign of the change in LIFO-Reserve. Periodic stock management also known as periodic stock taking or a periodic inventory system is a type of inventory valuation whereby a business conducts a physical count of the inventory at specific intervals. … The ending inventory is only updated after a physical inventory count has been conducted. Last in, first out is a method used to account for inventory.

For external financial reports, the LIFO method is typically used. The LIFO method places a higher rate of cost on all the goods that a company sells over the period of a year. With reports that show a higher cost to the company, it also means that less income eligible for taxes is reported alongside it. This is specifically important when sharing things like tax returns with the government because it means the amount of taxes the company accrues is likely to be lower. We can explain LIFO Reserve is a contra inventory account. It indicates the difference between LIFO and FIFO inventory method reporting. Ratios analysis is a useful tool to evaluate and compare the liquidity, profitability, and solvency of companies.

What Is Periodic Management?

Both methods have different impacts on the financial performance reporting and financial ratios of companies. Therefore, the stockholders must be able to find a uniform space to analyze any company’s health irrespective of cost method. The Fine company uses FIFO method for internal reporting and LIFO method for external reporting. The inventory on December 31, 2021 is $180,000 under FIFO and $130,000 under LIFO. The LIFO reserve account showed a credit balance of $30,000 on January 1, 2021. Though it is widely known as LIFO reserve, the use of term “reserve” is much debated as recording of this difference is actually recognizing contra asset against inventory account. Therefore, accountants are using alternative terms such as;LIFO allowance, LIFO effect, LIFO revaluation, Excess of FIFO over LIFO costetc.

The recent runup in oil prices and general inflation have boosted tax benefits from the “last-in, first-out” inventory accounting tax break. LIFO tax expenditures, or foregone federal tax revenues, are concentrated in the petroleum industry, which is posting record profits.

The Tax Adviser is available at a reduced subscription price to members of the Tax Section, which provides tools, technologies and peer interaction to CPAs with tax practices. The Section keeps members up to date on tax legislative and regulatory developments. The current issue of The Tax Adviser is available at /pubs/taxadv. The uniform and single file flow of goods provides efficient control of materials. This control is needed for goods that can be subjected to decay, deterioration, and quality or style change. The petroleum industry is by far the largest beneficiary, although its share of LIFO reserves fluctuates with oil prices.

Therefore, CPAs may be called upon to help manage inventory method changes. Companies using LIFO would have to switch to FIFO or average cost.

Why Should Lifo Be Eliminated?

Similarly if we have cost of sales under FIFO method we can determine cost of sales under LIFO method by adding the LIFO reserve in FIFO based cost of sales. And again remember, cost of sales under FIFO will be based on cost lower than the cost on which LIFO cost of sales is calculated. Because of these benefits, entities may choose to report profits on the basis of LIFO but use FIFO for internal reporting, cost accounting or other decision making purposes. Another major difference between IFRS and GAAP is that IFRS requires entities to carry inventory at the lower of cost or net realizable value. GAAP, on the other hand, values inventories at the lower of cost or current replacement cost, which is subject to a ceiling of net realizable value and a floor of net realizable value minus a normal profit margin.

This will mean that the profitability ratios will be smaller under LIFO than FIFO. Companies may well be reluctant to move to IFRS for inventory reporting if they are using LIFO, unless the LIFO conformity rule were relaxed. Perhaps they would be allowed to still report LIFO for tax but to adhere to IFRS for accounting. Maybe two sets of financial statements, one on IFRS, the other on GAAP permitting LIFO, would be allowed. Another possibility would be for the Treasury Department to extend the period over which those tax obligations are due beyond the currently allowed four years.

In this situation the IRS requires the corporation pay the LIFO tax recaptured ratably over a four year period without interest. In a sale of stock of a dealership corporation, the impact of the LIFO reserve is quite different from an asset sale. When valuing the stock, the book net worth is generally increased by the LIFO reserves and decreased to compensate for an estimate of the future income tax impact on the LIFO reserves. Ford Motor Co. is considering alternate methods of accounting for the cash discounts it takes when paying suppliers promptly. One method suggested was to report these discounts as financial income when payments are made. The change in the inventory level from one period to another whether base year cost level or current cost level is called the LIFO layer.

I have just seen a counter-example where there is a decrease in LIFO-Reserve in a LIFO liquidation situation, and it’s not a deflationary environment. Rather than try to re-prove it mathematically, I’ll simply accept that the above calculations are perhaps too simplistic. Hundreds of companies & CPA firms utilize our LIFO outsourcing solutions or the LIFO-PRO software for turnkey LIFO solutions. Facts describing why the double-extension LIFO index calculation method is unreliable and examples proving how this method creates unpredictable results. Register a Deal Have a sales opportunity that you want protection on? Become a Partner Already know Wasp is a perfect match for your business?